Preliminary Second Quarter Results

· Consolidated net sales of $1.39 billion

· Core net sales of $1.05 billion*

· GAAP income from continuing operations of $75 million

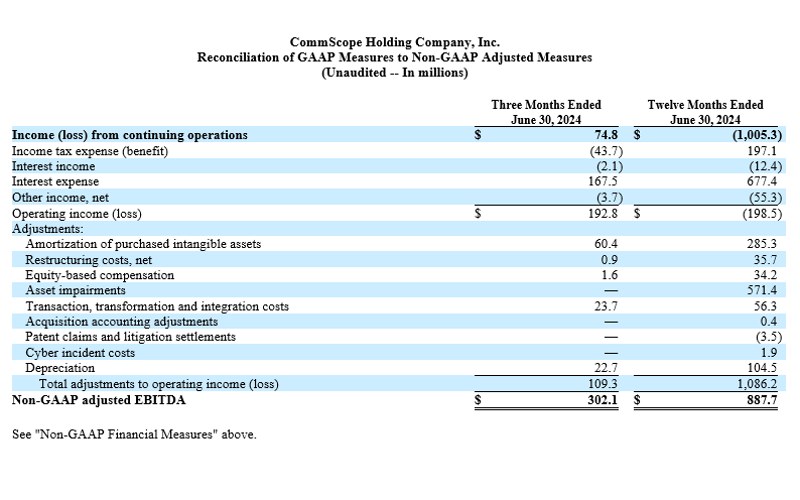

· Consolidated non-GAAP adjusted EBITDA of $302 million(1)

· Core non-GAAP adjusted EBITDA of $201 million*(1)

* Core financial measures exclude the results and performance of our Outdoor Wireless Networks (OWN) segment and Distributed Antenna Systems (DAS) business unit of our Networking, Intelligent Cellular & Security Solutions (NICS) segment of $333 million of net sales and $101 million of non-GAAP adjusted EBITDA. See “Core Measures” below.

(1) See “Non-GAAP Financial Measures” and “Reconciliation of GAAP Measures to Non-GAAP Adjusted Measures” below.

CLAREMONT, NC, July 29, 2024 — CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, is reporting preliminarily results for the quarter ended June 30, 2024.

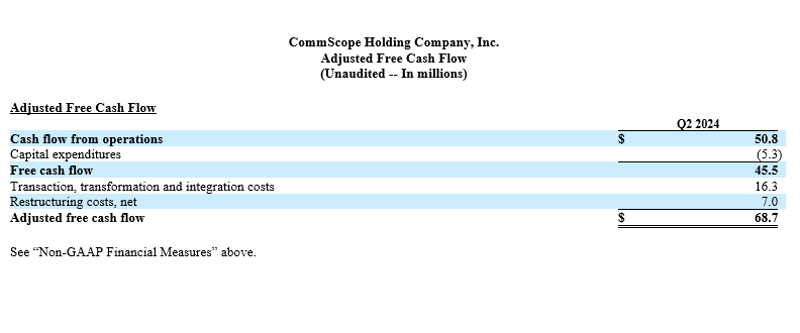

Second quarter 2024 CommScope Net Sales are expected to be $1.39 billion, with Core Net Sales of $1.05 billion. Net sales were positively supported by stronger-than-expected Connectivity and Cable Solutions (CCS) and OWN segment performance, partially offset by significantly weaker NICS and Access Network Solutions (ANS) sales. Our CCS and OWN segments benefited from customers normalizing inventory levels in the quarter and increased demand for our products in several key business units. GAAP income from continuing operations for the quarter is expected to be $75 million. Non-GAAP adjusted EBITDA is expected to be $302 million and Core Non-GAAP adjusted EBITDA for the quarter is expected to be $201 million. Second quarter 2024 Non-GAAP adjusted Free Cash Flow(1)is expected to be $69 million, and Cash and Cash Equivalents at the end of the quarter are expected to be $346 million. On a twelve-month trailing basis, Non-GAAP adjusted EBITDA was $888 million on Net Sales of $5.1 billion, while Core Non-GAAP adjusted EBITDA was $603 million on Core Net Sales of $3.9 billion. Trailing-twelve-month Core Non-GAAP adjusted EBITDA and Core Net Sales exclude the results and performance of our OWN segment and DAS business unit of our NICS segment of $285 million of Non-GAAP adjusted EBITDA and $1.16 billion of Net Sales.

“Throughout the first half of this year, we navigated uncertainty and depressed market conditions in many of our business units. However, we saw improvement in our second quarter Core performance driven by strength in our CCS segment, specifically our datacenter and cloud business. Additionally, customer inventory levels have continued to show signs of stability. Despite these positive trends, visibility remains limited as we move into the second half of the year,” said Chuck Treadway, President and CEO of CommScope.

“CommScope continues to explore alternatives to address its capital structure, leveraging the flexibility available to us in our credit documents,” Treadway continued. “We expect to engage with our lenders and bondholders in the third quarter to discuss options to deleverage our balance sheet and address our upcoming maturities.”

Earlier this month, CommScope entered into a definitive agreement to sell its OWN segment as well as the DAS business unit of the NICS segment to Amphenol Corporation (NYSE: APH). Upon closing, CommScope will receive $2.1 billion in cash and is expected to complete the transaction in the first half of 2025.

The expected second quarter 2024 results set out above are still preliminary and subject to the Company’s quarter-end close procedures. The Company’s consolidated financial statements as of, and for the three months ended, June 30, 2024 are not yet available. Accordingly, the information presented herein reflects the Company’s preliminary estimates subject to the completion of the Company’s financial closing procedures and any adjustments that may result from the completion of the quarterly review of the Company’s consolidated financial statements. As a result, these preliminary estimates may differ from the actual results that will be reflected in the Company’s consolidated financial statements for the second quarter when they are completed and publicly disclosed. These preliminary estimates may change and those changes may be material. The Company’s expectations with respect to its unaudited results for the period discussed above are based upon management estimates.

Conference Call, Webcast and Investor Presentation

As previously announced, CommScope will host a conference call on August 8th at 8:30 a.m. ET in which management will discuss second quarter 2024 results. The conference call will also be webcast.

The live, listen-only audio of the call will be available through a link on the Events and Presentations page of CommScope’s Investor Relations website.

A webcast replay will be archived on CommScope’s website for a limited period of time following the conference call.

During the conference call, the Company may discuss and answer questions concerning business and financial developments and trends that have occurred after quarter-end, including questions relating to the planned sale of our OWN segment and DAS business unit. The Company’s responses to questions, as well as other matters discussed during the conference call, may contain or constitute information that has not been disclosed previously.

About CommScope:

CommScope (NASDAQ: COMM) is pushing the boundaries of technology to create the world’s most advanced wired and wireless networks. Our global team of employees, innovators and technologists empower customers to anticipate what’s next and invent what’s possible. Discover more at www.commscope.com.

Follow us on Twitter and LinkedIn and like us on Facebook. Sign up for our press releases and blog posts.

Investor Contact:

Massimo Disabato, CommScope

Massimo.Disabato@commscope.com

News Media Contact:

publicrelations@commscope.com

Non-GAAP Financial Measures

CommScope management believes that presenting certain non-GAAP financial measures enhances an investor’s understanding of our financial performance. CommScope management further believes that these financial measures are useful in assessing CommScope’s operating performance from period to period by excluding certain items that we believe are not representative of our core business. CommScope management also uses certain of these financial measures for business planning purposes and in measuring CommScope’s performance relative to that of its competitors. CommScope management believes these financial measures are commonly used by investors to evaluate CommScope’s performance and that of its competitors. However, CommScope’s use of certain non-GAAP terms may vary from that of others in its industry. Non-GAAP financial measures should not be considered as alternatives to operating income (loss), net income (loss), cash flow from operations or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance, operating cash flows or liquidity. A reconciliation of each of the non-GAAP measures discussed herein to their most comparable GAAP measures is below.

Core Measures

CommScope believes that presenting Core financial measures enhances the investor’s understanding of the financial performance of the Company’s core businesses. Core financial measures are the aggregate of the CCS, NICS (excluding DAS), and ANS segments. They do not include the results of the OWN segment and DAS business unit. The Core results and the OWN and DAS results represent the business results as currently managed and reported by CommScope. Future results and the composition of any business divested in the future may vary and differ materially from the presentation of the Core financial measures.

Forward Looking Statements

This press release or any other oral or written statements made by us or on our behalf may include forward-looking statements that reflect our current views with respect to future events and financial performance. These statements may discuss goals, targets, intentions or expectations as to future plans, trends, events, results of operations or financial condition or otherwise, in each case, based on current beliefs and expectations of management, as well as assumptions made by, and information currently available to, management. These forward-looking statements are generally identified by their use of such terms and phrases as “intend,” “goal,” “estimate,” “expect,” “project,” “projections,” “plans,” “potential,” “anticipate,” “should,” “could,” “designed to,” “foreseeable future,” “believe,” “think,” “scheduled,” “outlook,” “target,” “guidance” and similar expressions, although not all forward-looking statements contain such terms. This list of indicative terms and phrases is not intended to be all-inclusive.

These forward-looking statements are subject to various risks and uncertainties, many of which are outside our control, including, without limitation, statements regarding the expected timing of the closing of the sale of the OWN and DAS businesses (the “Transaction”); the expected benefits of the Transaction, including the expected financial performance of CommScope following the Transaction; the ability of the parties to obtain any required regulatory approvals in connection with the Transaction and to complete the Transaction considering the various closing conditions; expenses related to the Transaction and any potential future costs; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive agreement governing the Transaction, or an inability to consummate the Transaction on the terms described or at all; the effect of the announcement of the Transaction on the ability of CommScope to retain and hire key personnel and maintain relationships with its key business partners and customers, and others with whom it does business, or on its operating results and businesses generally; the response of CommScope’s competitors, creditors and other stakeholders to the Transaction; risks associated with the disruption of management’s attention from ongoing business operations due to the Transaction; the ability to meet expectations regarding the timing and completion of the Transaction; potential litigation relating to the Transaction; restrictions during the pendency of the Transaction that may impact the ability to pursue certain business opportunities; the impact of the quarter-end close procedures on the preliminary estimates of the quarterly results contained herein; our dependence on customers’ capital spending on data, communication and entertainment equipment, which could be negatively impacted by a regional or global economic downturn, among other factors; the potential impact of higher than normal inflation; concentration of sales among a limited number of customers and channel partners; risks associated with our sales through channel partners; changes to the regulatory environment in which we and our customers operate; changes in technology; industry competition and the ability to retain customers through product innovation, introduction, and marketing; changes in cost and availability of key raw materials, components and commodities and the potential effect on customer pricing and timing of delivery of products to customers; risks related to our ability to implement price increases on our products and services; risks associated with our dependence on a limited number of key suppliers for certain raw materials and components; risks related to the successful execution of CommScope NEXT; potential difficulties in realigning global manufacturing capacity and capabilities among our global manufacturing facilities or those of our contract manufacturers that may affect our ability to meet customer demands for products; possible future restructuring actions; the risk that our manufacturing operations, including our contract manufacturers on which we rely, encounter capacity, production, quality, financial or other difficulties causing difficulty in meeting customer demands; substantial indebtedness and restrictive debt covenants; our ability to refinance existing indebtedness prior to its maturity or incur additional indebtedness at acceptable interest rates or at all; our ability to generate cash to service our indebtedness; the divestiture of the Home segment and its effect on our remaining businesses; the potential separation, divestiture or discontinuance of another business or product line, including uncertainty regarding the timing of the separation, achievement of the expected benefits and the potential disruption to the business; our ability to integrate and fully realize anticipated benefits from prior or future divestitures, acquisitions or equity investments; possible future additional impairment charges for fixed or intangible assets, including goodwill; our ability to attract and retain qualified key employees; labor unrest; product quality or performance issues, including those associated with our suppliers or contract manufacturers, and associated warranty claims; our ability to maintain effective management information technology systems and to successfully implement major systems initiatives; cyber-security incidents, including data security breaches, ransomware or computer viruses; the use of open standards; the long-term impact of climate change; significant international operations exposing us to economic risks like variability in foreign exchange rates and inflation, as well as political and other risks, including the impact of wars, regional conflicts and terrorism; our ability to comply with governmental anti-corruption laws and regulations worldwide; the impact of export and import controls and sanctions worldwide on our supply chain and ability to compete in international markets; changes in the laws and policies in the United States affecting trade, including the risk and uncertainty related to tariffs or potential trade wars and potential changes to laws and policies, that may impact our products; the costs of protecting or defending intellectual property; costs and challenges of compliance with domestic and foreign social and environmental laws; the impact of litigation and similar regulatory proceedings in which we are involved or may become involved, including the costs of such litigation; the scope, duration and impact of disease outbreaks and pandemics, such as COVID-19, on our business, including employees, sites, operations, customers, supply chain logistics and the global economy; our stock price volatility; income tax rate variability and ability to recover amounts recorded as deferred tax assets; and other factors beyond our control. These and other factors are discussed in greater detail in our 2023 Annual Report on Form 10-K and may be updated from time to time in our annual reports, quarterly reports, current reports and other filings we make with the Securities and Exchange Commission. Although the information contained in this press release represents our best judgment as of the date of this release based on information currently available and reasonable assumptions, we can give no assurance that the expectations will be attained or that any deviation will not be material. Given these uncertainties, we caution you not to place undue reliance on these forward-looking statements. Any assumptions, views or opinions (including forward-looking statements) contained in this press release represent the assumptions, views or opinions of CommScope, as of the date indicated and are subject to change without notice. All forward-looking statements contained in this press release are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made, and CommScope disclaims any obligation to update publicly any of these statements to reflect actual results, new information, or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If CommScope updates one or more forward-looking statements, no inference should be drawn that CommScope will make additional updates with respect to those or other forward-looking statements. All information not separately sourced is from internal company data and estimates. Any data relating to past performance contained herein is no indication as to future performance. The information in this press release is not intended to predict actual results, and no assurances are given with respect thereto. The information contained in this press release has not been independently verified, and no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information contained herein and no reliance should be placed on it. None of the Company or any of its affiliates, advisers, affiliated persons or any other person accept any liability for any loss howsoever arising (in negligence or otherwise), directly or indirectly, from this press release or its contents or otherwise arising in connection with this press release. This shall not, however, restrict or exclude or limit any duty or liability to a person under any applicable law or regulation of any jurisdiction which may not lawfully be disclaimed (including in relation to fraudulent misrepresentation).

END